October 2021 Employee Benefits Compliance Alerts

2020 Massachusetts HIRD Form Filing Window Approaches for Employers

1. What do you need to do?

Attention, Massachusetts employers with six or more employees in Massachusetts: The Annual Health Insurance Responsibility Disclosure (HIRD) form is due no later than December 15, 2021. Filing can be done as early as November 15, 2021, on the MassTaxConnect (MTC) Web Portal.

2. Why do you need to do it?

In 2018, the Commonwealth of Massachusetts reintroduced the HIRD form, which originated under Massachusetts Health Care Reform in 2006. The HIRD form is a state reporting requirement that collects information about your employer-sponsored insurance (ESI). HIRD reporting is administered by MassHealth and the Department of Revenue (DOR) through the MTC web portal. The HIRD form will assist MassHealth in identifying its members with access to qualifying ESI who may be eligible for the MassHealth Premium Assistance program.

If you employ or employed six or more employees in Massachusetts in any month from December 15, 2020, through December 14, 2021, you will need to submit a HIRD form. Employees are defined as full-time, part-time, or any employee who is hired to perform work for a wage or salary in Massachusetts, regardless of whether or not you are required to file a Department of Unemployment Assistance (DUA) report.

The HIRD form consists of questions related to each medical plan that you offer. Some information, such as deductibles and out-of-pocket maximum levels, may be found within your Summary of Benefits.

You may also be asked to provide:

- Eligibility waiting periods

- Minimum hours worked per week to qualify for health insurance

- Any eligibility categories—i.e., full-time, part-time, salary, hourly

- Plan year/renewal date

- Monthly cost for each plan, including employer and employee cost share

3. How do you do it?

The Commonwealth of Massachusetts provides the following instructions on filing through the MTC Web Portal:

- Log in to your MTC withholding account here.

- Select the “File health insurance responsibility disclosure” hyperlink under the account alerts.

If you do not have an MTC account, or if you forgot your password or username, you may follow the instructions provided on the MTC web page or contact DOR at 617-466-3940.

While it is the responsibility of the employer to ensure that the HIRD form is timely filed, the HIRD form may be filed on MTC by either you or your payroll company. You may want to contact your payroll provider to determine if it will provide this service on your behalf. Generally, payroll providers do not have access to all the pertinent information required to complete the online form. As a result, it is best to work in conjunction with your vendor to file your form(s).

4. Where can you get more information?

Massachusetts has released Frequently Asked Questions related to the HIRD form. These FAQs can be found here.

Source: www.mass.gov

October 20: Massachusetts Department of Family and Medical Leave Releases Updated Employee/Employer Resources

On October 20, the Department of Family and Medical Leave (DFML) released updated resources and guidance. Included in the update are helpful FAQs about how Paid Family and Medical Leave (PFML) interacts with other forms of leave, such as:

- Unemployment Insurance

- Workers’ Compensation

- Social Security programs

- Temporary disability

- Paid family and medical leave benefits through an employer

- Sick time through an employer

- Paid time off through an employer

- Working for an employer while receiving PFML benefits

- School breaks/vacation time for educators

The following are links to the recent updates available to educate and guide employers and employees through PFML:

- New: Employees can now check their Application Status.

- New: The Department of Family and Medical Leave (DFML) has published its FY2021 annual report.

- New: Average Weekly Wage and Maximum Benefit Amount Changes for 2022.

- New: Resource Center for Employees, with English, Spanish, and Portuguese versions.

- Updated: How other leave and benefits can affect your Paid Family and Medical Leave.

- Updated: Medical Leave form now includes multiple questions about pregnancy and childbirth.

- Updated: Paid Family and Medical Leave coverage for self-employed individuals.

- Updated: Paid Family and Medical Leave fact sheet.

Department Help Line: If you have any more questions, please call DFML at 833-344-7365 between the hours of 8 a.m. and 5 p.m.

Resources:

2022 Rate and Maximum Benefit Adjustment for Employer Contributions to the State Program

The Massachusetts Paid Family Medical Leave (PFML) statute and regulations require the Massachusetts Department of Family and Medical Leave (DFML) to publish every year, no later than October 1, what any rate adjustment would be for employer contributions to the state PFML trust fund. This year, the DFML announced that the following adjustments will take effect for those employers and employees enrolled in the state program as of January 1, 2022:

25 or More Employees

Effective January 1, 2022, the new contribution rate on eligible employee wages will be decreased to 0.68% for employers with 25 or more employees. The 2021 calendar year contribution rate for employers with 25 or more employees was 0.75% of eligible wages.

Fewer than 25 Employees

Effective January 1, 2022, employers with fewer than 25 covered individuals must remit an effective contribution rate of 0.344% of eligible wages. The 2021 calendar year contribution rate was 0.378% of eligible wages. Employers of this size, although excused from an employer contribution, must still remit employee contributions.

New Maximum Benefit Amount

Beginning in January 2022, the maximum total amount that an employee can receive in PFML benefits will be $1,084.31 per week. The maximum weekly benefit was $850 for 2021.

State Finally Provides Guidance Regarding Avoiding Retroactive Contributions for New Admission into the State PFML Program

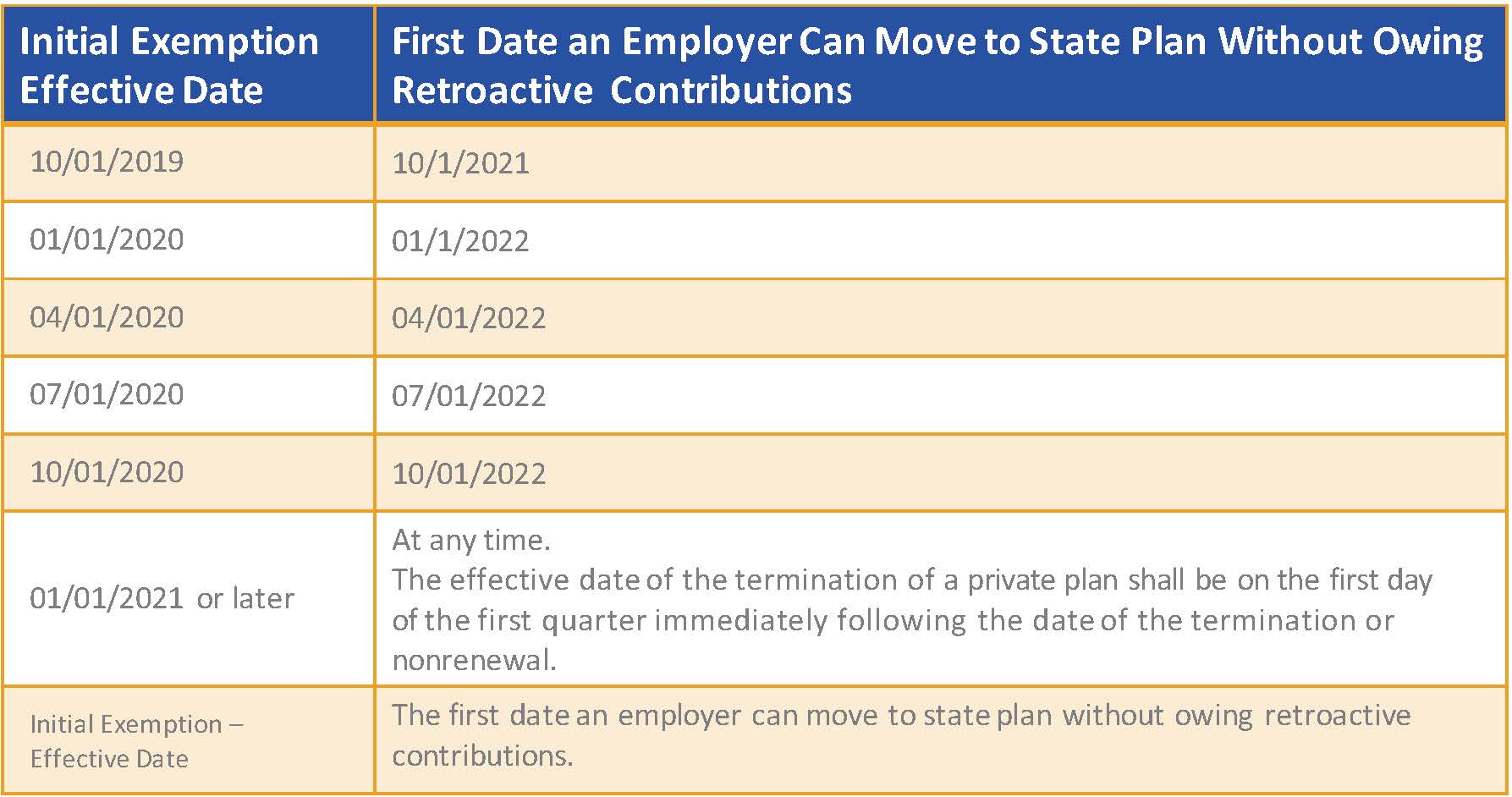

Employers with a private plan (fully insured or self-funded) exemption that was initially effective prior to January 1, 2021, will need to go through one (1) renewal cycle to not owe retroactive contributions. A renewal cycle means an initial term and one renewal term, with each term lasting a period of four completed quarters. An employer that terminates a private plan prior to the renewal cycle requirement will be responsible to remit retroactive contributions back to the effective date of the initial exemption for failure to renew.

If an employer has an approved exemption and has renewed for one renewal cycle, and the employer attempts to terminate during that first renewal cycle (before the renewal cycle is complete), they, too, will be responsible to remit retroactive contributions back to the effective date of the initial exemption for failure to renew.

If an employer has gone through one complete renewal cycle, at that time, such employer may terminate its private plan without owing retroactive contributions.

Here is a table that lays out concrete dates.

Note: If the PFML exemption effective date is not aligned with the carrier policy effective date, then the employer would be required to remain with the private plan until the PFML exemption end date, to ensure that there will be no gaps in coverage and they will not owe retroactive contributions and assessed penalties.

Additional Resources:

2021 Annual Report:

Note: This alert constitutes compliance advice from the Fred C. Church Agency as your employee benefits broker and does not establish an attorney-client relationship with the recipient, who is free to consult with legal or tax counsel of their own choosing.